Inflation is a pretty straightforward concept. Still, it is one of those economic variables that can be concerning to some investors. However, a basic understanding of inflation may help ease some of those concerns.

What is Inflation?

Inflation is simply an increase in prices. It can affect a single good or service. Or it can impact all goods and services in the whole economy. Inflation is generally considered to be negative, but it isn’t all bad. There are pros and cons.

The downside is that when goods and services cost more, the dollar doesn’t go as far as it used to. Inflation diminishes the value of money, forcing consumers to make choices about what and how much to buy. It forces them to budget.

The upside is that inflation is typically the result of a robust economy. Moderate inflation is a sign that businesses and consumers are spending. And aggregate spending is what keeps an economy healthy.

What Causes Inflation?

There is an old expression that price is a matter of supply and demand. And for the most part that statement goes a long way to explain inflation.

When an economy is booming and there’s plenty of money available, people are willing to spend it. The more people are out there spending money, the higher demand and the more likely prices are to rise. Economists call this a shift in demand.

Now, sometimes inflation can occur without a shift in demand. Changing supply can also affect prices.

A shift in supply can happen for a lot of reasons. Some are straightforward. For example, a slowdown in production can decrease the number of finished goods coming out of a factory. A shortage of raw materials can do the same thing.

Then there are factors that are less intuitive. For example, if there aren’t enough people coming in to work, it can decrease a company’s ability to fill customer orders. A backup in the supply chain – getting goods from one place to another – can reduce the supply of goods available to consumers. Both can affect inflation.

A real-life example of these phenomenon was created by the COVID-19 pandemic. Many people missed work, factories were not producing at capacity and there was an overall slowing of the global supply chain.

Should you be Concerned About Inflation?

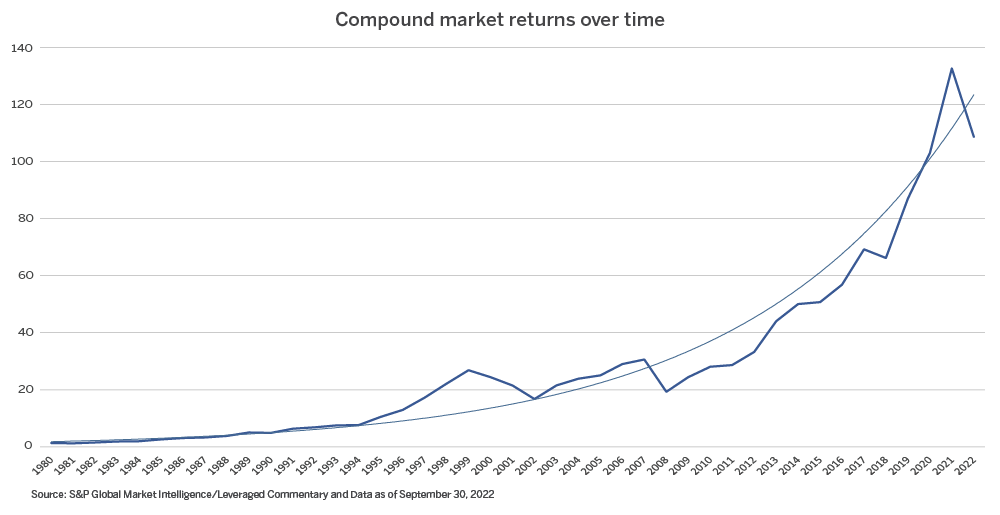

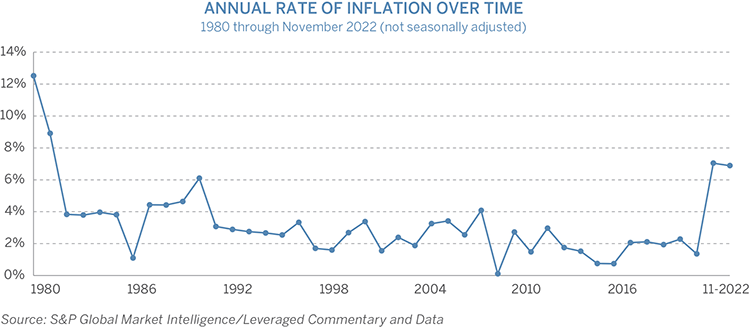

Americans have gotten used to very low inflation for a very long time. It has averaged right around three percent since 1980. That may be why recent increases in inflation have concerned some investors.

But the correlation between inflation and long-term investment performance is not perfect. Still, inflation has had an impact on other economic indicators. For example, inflation can affect interest rates, which then impacts stock and bond prices.

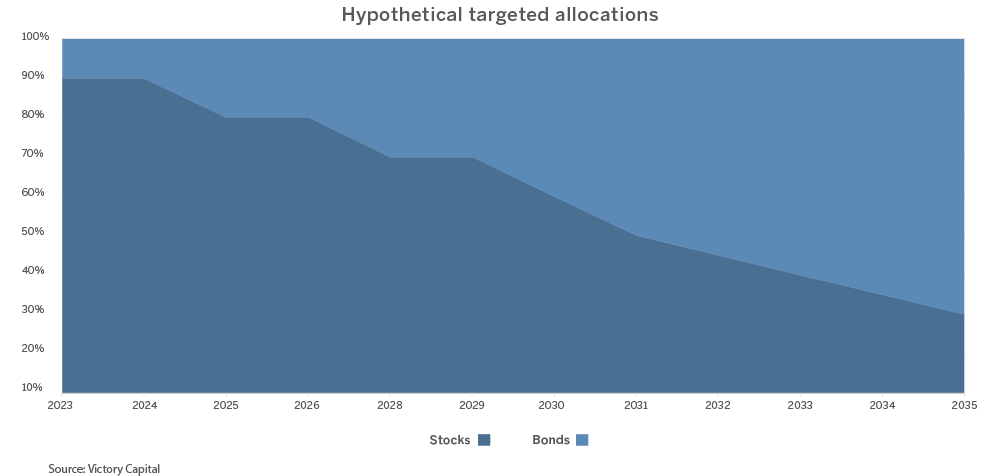

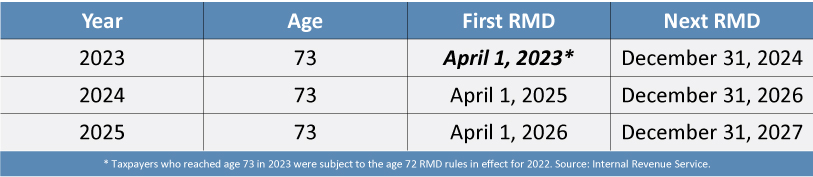

So, the degree to which investors should be concerned about inflation may depend on the type of investments they own, their age and their circumstances.

Working with experienced financial professionals can help you stay the course. They can provide guidance and encouragement to help focus your attention on your long-term goals.