The benefit of automating your investment plan

Building a large nest egg may seem out of reach for many people. This is especially the case for a family living on a budget. What is attainable for one person may not be for another. But there is one technique that can help many people reach their unique personal milestones – and possibly achieve their most important financial goals. What is this time-tested method? Accumulate funds gradually through recurring monthly investments.

How to Walk Across America

Accumulating a large nest egg is similar to any seemingly monumental task. You have to tackle it methodically. Like walking across the United States, accumulating a substantial amount of money can seem like a daunting task. But both are achievable if you approach them one step at a time.

Crossing the U.S. on foot will take about six months. Amassing a healthy nest egg takes longer. A lot longer. The good news is that time is on your side.

If you start working at age 20 and retire when you’re 65 you’ll spend 45 years on the job. If you’re an average wage earner, that means you haul in just shy of $52,000 a year1. That’s more than $2.3 million over the course of your working life. There’s a smart way to save some of it.

Enter an Automatic Investment Plan

For this illustration, let’s assume you make investments in mutual funds. They make the gradual accumulation technique easy to implement. This is because mutual funds can be configured with an Automatic Investment Plan (AIP).

And an automatic investment plan that uses mutual funds can also be structured to reinvest income and capital gains distributions into those funds. This can create the opportunity for additional compounding (your investment’s returns earn an additional return).

An AIP is a consistent investment program that you don’t have to think about. Your contributions accumulates over time (as its name accurately portrays…automatically). This can be an effective way to build wealth.

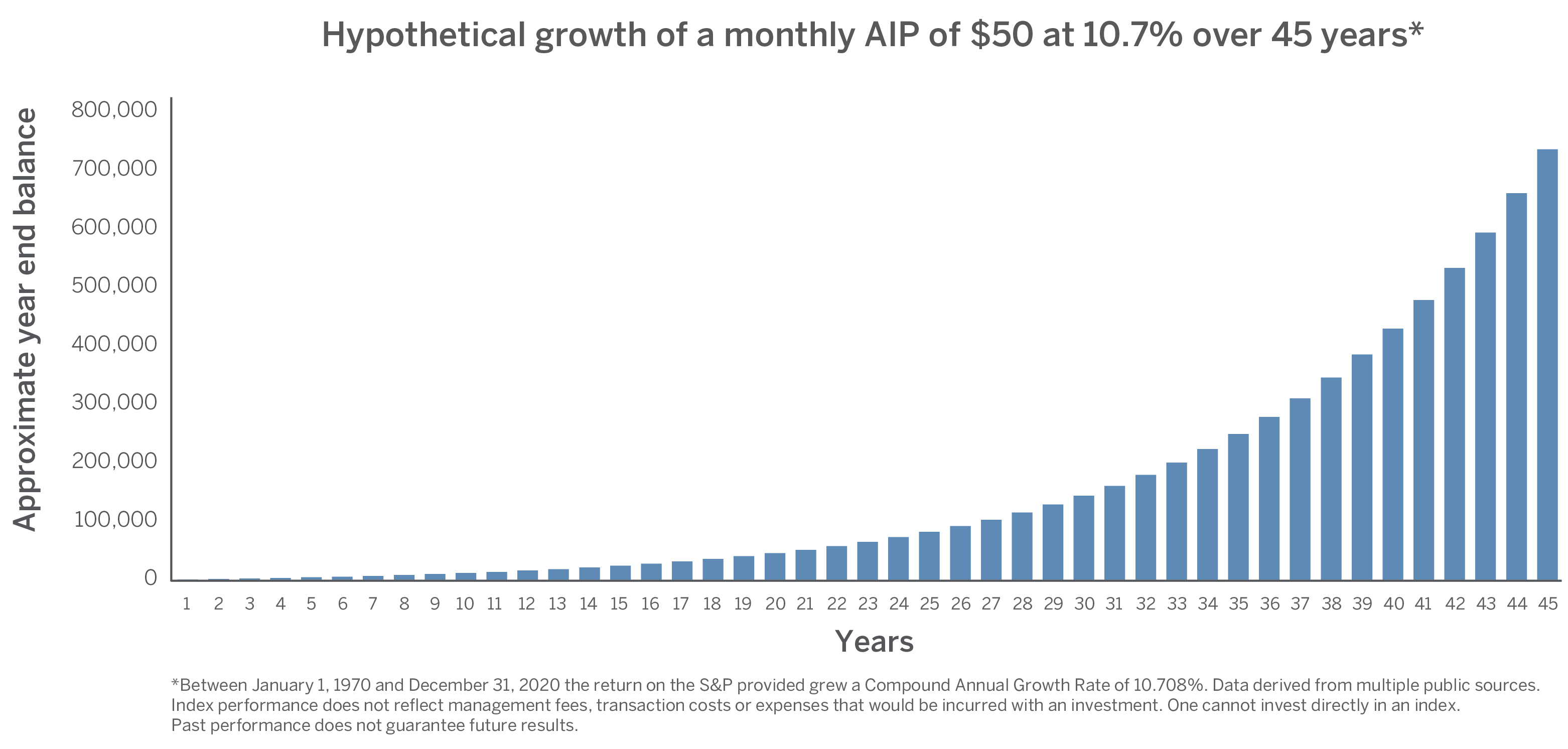

If you can afford coffee and a donut every morning, you likely have the means necessary to eventually amass a pretty decent nest egg. An automatic investment plan of just $50 per month would accumulate to more than $736,000 in about 45 years, assuming it generated the same return that the S&P 500 has delivered since 1970.

Now, it’s important to note that most people need a whole lot more than this in retirement. So, those with the means should consider a larger AIP…in fact as much as you can afford!

In other words, following a consistent investment program and contributing about what it costs for a quick daily snack, may be enough to build a solid retirement portfolio over the course of someone’s working life.

The Benefits of an Automatic Investment Plan

An AIP is an arrangement where you invest a set dollar amount on a set schedule into set investments (like mutual funds). It creates a disciplined regimen intended to help you achieve long-term investment goals. It essentially puts your wealth accumulation on autopilot.

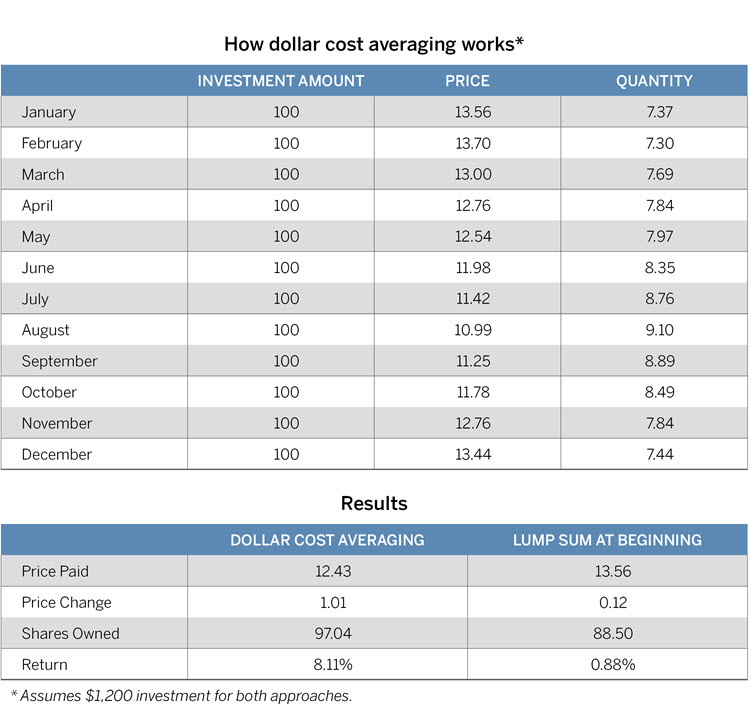

An automatic investment plan may also help lower the average cost of an investment in the short run. Markets can be volatile. They rise and fall. An AIP takes advantage of volatility because it makes investments regardless of share price.

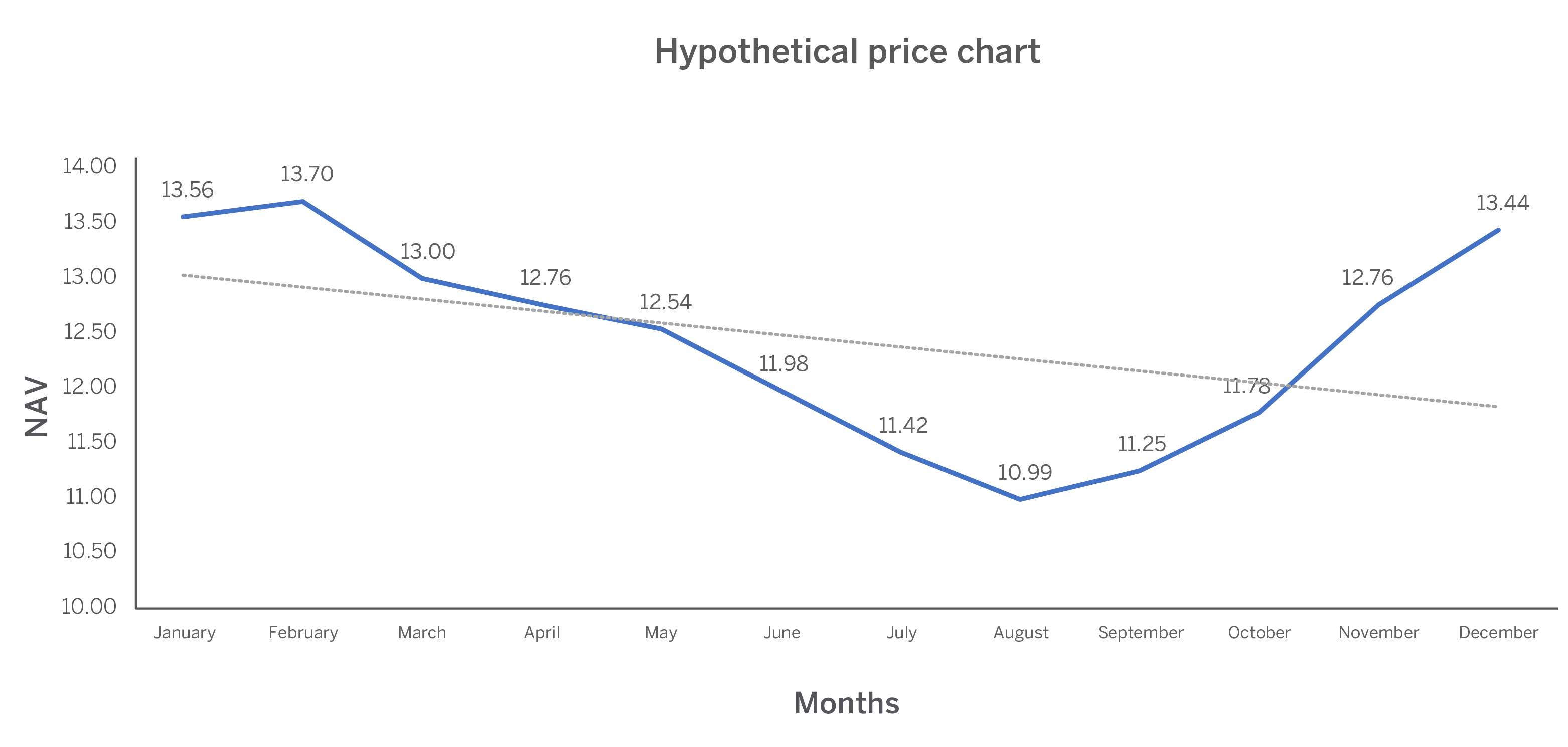

For example, assume you have an AIP in which you invest $100 in a mutual fund every month. The chart below illustrates how that fund’s price, or Net Asset Value (NAV) may change over the course of a year. In some months that price will be higher than other months. Sometimes it will be lower. For example, in February, your purchase price would have been close to $14. In August, it was closer to $11. The investments are made on a schedule unrelated to market movement.

In some months that price will be higher than other months. Sometimes it will be lower. For example, in February, your purchase price would have been close to $14. In August, it was closer to $11. The investments are made on a schedule unrelated to market movement.

When you blend them altogether, you end up buying the fund at a price lower than the highest price of the year and higher than the lowest price. So, an automatic investment plan is a form of a well-known investment method called dollar cost averaging.

The Most Important Parts of the Plan

Systematic investing is an effective way to grow a portfolio. But there are two critical elements of the plan. One is to invest as much as you can afford. The other is to start as early as possible.

Investment success doesn’t come from timing the market. It comes from time in the market. So, the sooner you start (and the more you can invest), the greater your chances of success.

If you want to increase your chances of investment success, increase your current AIP! If you don’t already have one, call us today to set one up. Call now: (800) 235-8396.

1 According to the Social Security Administration, Average Net Compensation in 2019 was $51,916.27.