History shows that every bull market eventually comes to an end. Now, don’t freak out. But at a certain point, stocks will enter a new bear market. And this begs the question. What can you do about it? Before we go there, let’s put this into context.

What Creates Bear Markets?

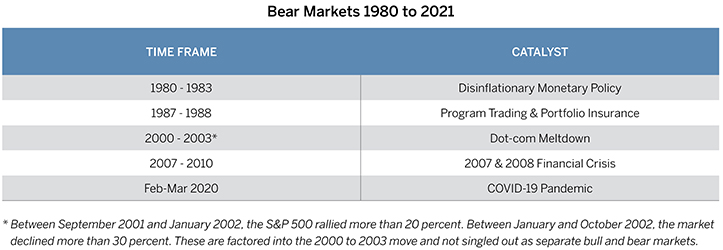

A bear market occurs when major market indexes decline by 20 percent or more. And there are lots of reasons why this can happen.

Typical market-moving catalysts include things like corporate earnings, macroeconomic conditions, and geopolitical events. But intangible things like sentiment and perception can also be catalysts. Either way, the end result has been pretty much the same.

A fear that something might happen can disrupt markets just as severely as evidence that something bad has already occurred.

How Common are Bear Markets?

Bear markets make headlines because they can be dramatic, not because they are uncommon. Even more common are the smaller, but no less unnerving, “market corrections” that periodically create 10 to 15 percent declines.

All of this volatility is part of the market cycle – from peak to trough and back – that roughly follows the business cycle and regular economic activity. It may be off-putting but it isn’t abnormal.

There have been about 30 bear markets in the last century; one every three or so years. Some have lasted a few months. The 2020 COVID-19 swoon lasted just 33 days. Others have lasted over two years.

But there are a few conclusions that can be drawn about each downturn.

1) Bear markets – regardless of duration – have always been temporary

2) Bear markets have always been followed by bull markets

3) Staying invested through a bear market has proven to be a reasonable investment strategy for long-term investors

Investing at a Market Peak

Still, some investors fear that the market will decline soon after they get fully invested or that a bear market will wipe out all of their previous gains. Both are reasonable concerns. To relieve these worries, just look to history.

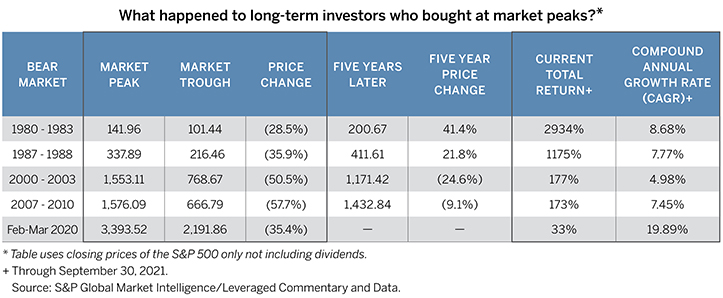

The table above illustrates that the market delivered positive rates of return in the majority of instances as early as five years after the previous cyclical peak.1 Longer-term returns were positive in every case.

This suggests that patient long-term investors who bought at “the top” and held their investments would have been rewarded for waiting.

In most cases, the gains are close to the historical mean rate of return for common stocks.2 This suggests that staying the course was a reasonable investment strategy. But there’s a bigger lesson here.

These positive returns are the result of doing nothing after making the initial investment. And there are a number of ways investors in this situation could have improved this performance.

Download Investment Strategies For Turbulent Markets

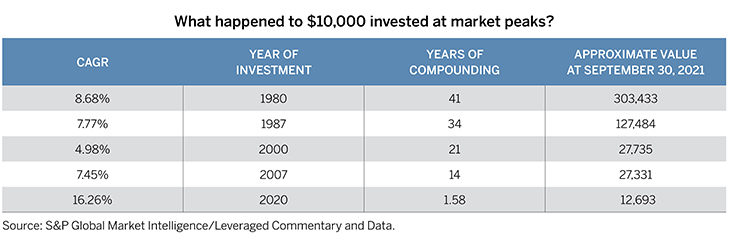

Simply adding to their initial investments could have improved returns. And in most cases, there was ample opportunity to do this.

Capitalizing on Market Downturns

After the 1980 decline, it took more than two years for the market to reach its previous peak. After the 1987 crash, it was just under two years. Investments made during those two periods would have helped investors lower their average cost and improve their long-term returns.

This is generally true for most declines. Averaging into them may improve your cost and investment return. Because declines are part of the normal ebb and flow of the way the market works, they generally create opportunities.

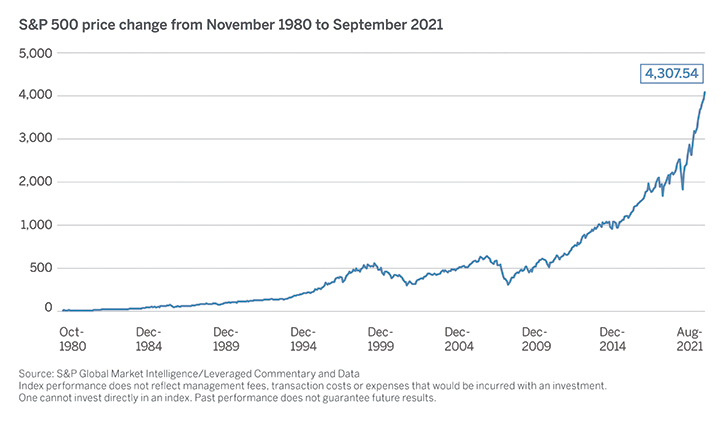

As history shows, bear markets are always followed by bull markets. So, you can use them to your advantage. This is especially the case if you are just beginning your investment journey and have a long-term perspective.

As the chart above illustrates, stock prices have followed an upwardly-sloping path over time. The more time you have, the greater your chances may be of riding that slope to profit. Time is on an investor’s side.

The Next Bear Market

There’s a pretty good chance that stocks will enter a new bear market at some point. But things like that are difficult to predict. That’s why it makes sense to have a plan. Let us help.

You can reach us at (800) 235-8396.

1 Illustration uses the S&P 500 Index. NOTE: Index performance does not reflect management fees, transaction costs or expenses that would be incurred with an investment. One cannot invest directly in an index. Past performance does not guarantee future results.

2 Through September 30, 2021.