Inflation is a rise in the general price level of goods and services in an economy. There are reasons why prices rise over time. They are typically the result of changes in the economy. Economic change is also an element that can drive investment prices. This article explains how changes in the economy affect inflation and how inflation impacts investments.

Connecting the dots Between Inflation and Investments

Inflation and investment value are related because they share a common source: business activity. History shows that:

- The business cycle can impact inflation

- Inflation’s impact on stocks is temporary

- Inflation’s impact on bonds is more durable

How the business cycle impacts inflation

Consumers are the main driver of the U.S. economy.1 When you feel good about your finances, you typically spend money.

More spending leads to increased production, which improves business revenues and leads more workers getting hired. In the aggregate, this defines a healthy economy. But sometimes inflation can be a byproduct.

For example, when demand is higher than supply, prices typically rise. This is true of goods and services and jobs.

People are willing to pay a premium for scarce items. And when there are more jobs than applicants to fill them, employers must raise wages to attract them. This can lead to higher prices.

But mild inflation is actually a sign of a healthy economy. It is also preferable to the alternative. Falling prices are a sign of a weak economy, or a recession.

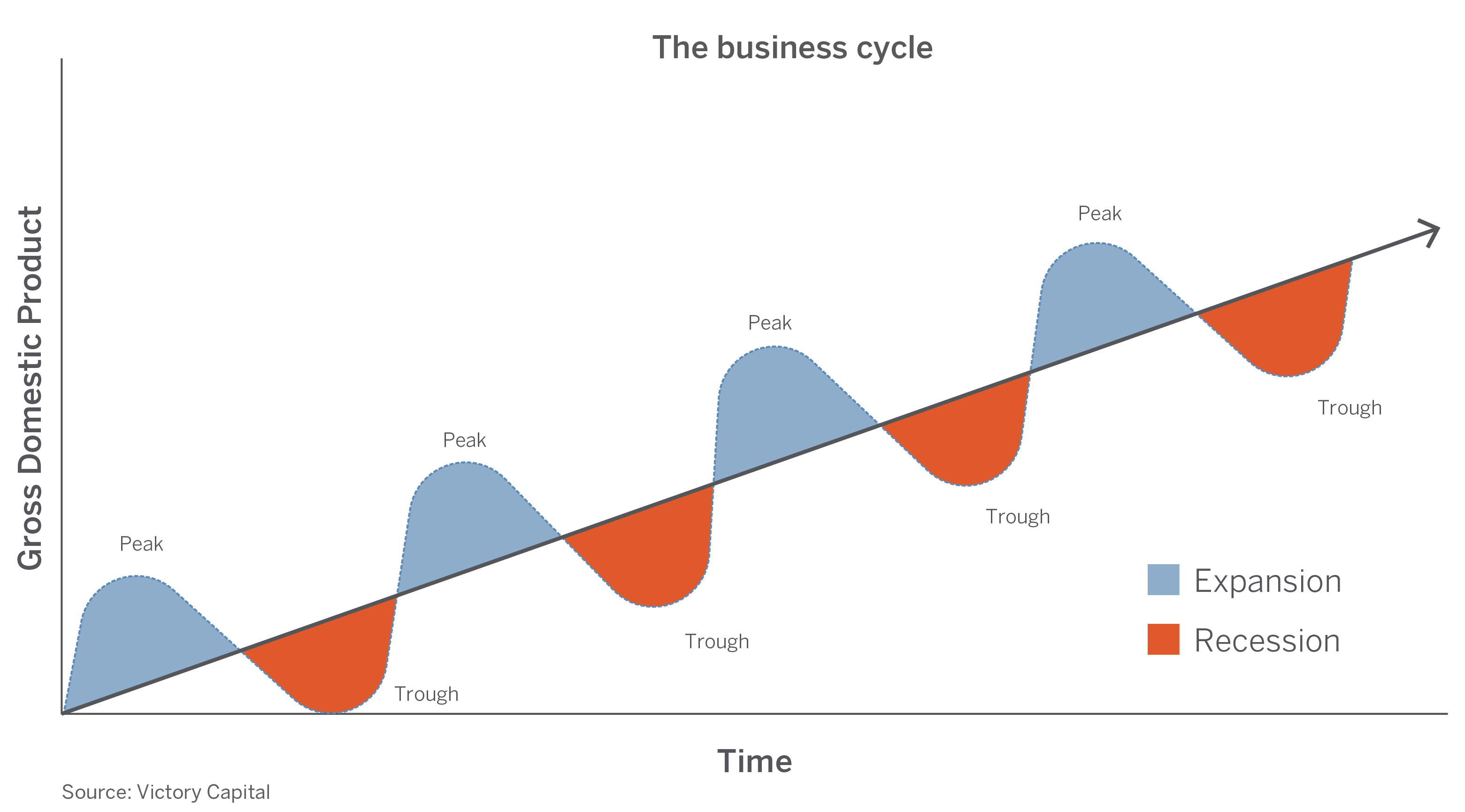

All economic activity – expansions, contractions, recoveries and recessions – defines the business cycle.

Inflation is a normal part of the process.

Inflation’s Impact on Stocks is Temporary

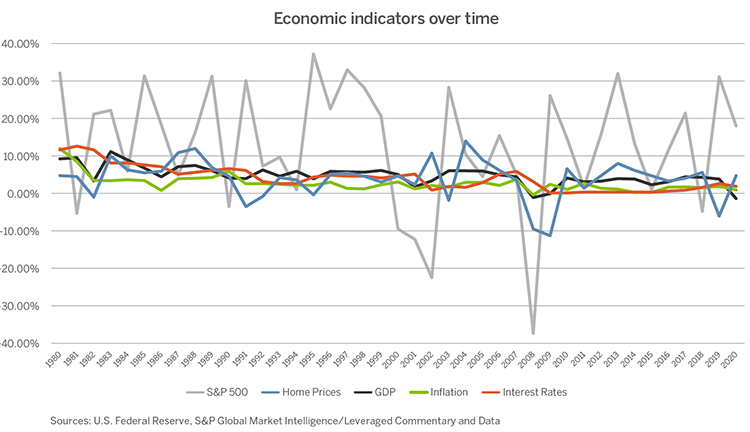

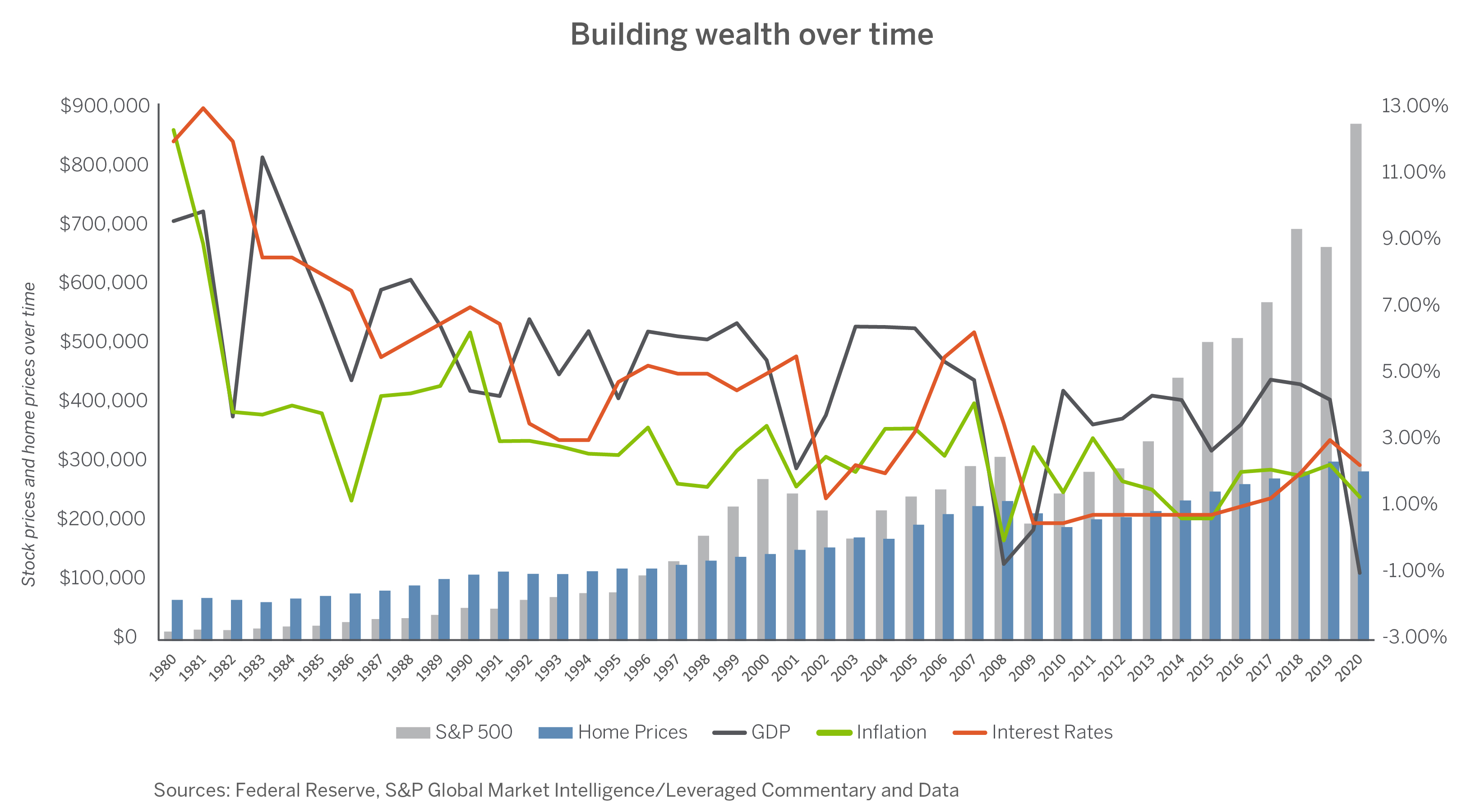

Since the 1960s, the U.S. economy has experienced periods of both high and low inflation. Throughout this period, stock price performance outpaced the rate of inflation.2

So, inflation does not appear to influence stock prices in the long run. But in the short-term, inflation can have a negative impact on stock price performance – especially when inflation is high.

The chart below helps highlight this. It depicts the period between 1965 and 1982. Historians characterize those years as “the great inflation” because at one point inflation was over 14 percent.3

But common stocks rose during this prolonged inflationary period. The advance was not continuous, but it averaged more than 8 percent annually.

During the great inflation, there were several years in which stock priced declined. Most of those declines came within a year of inflation ratcheting higher.

The above chart suggests that high inflation is bad for stocks – especially in the short run. But it also appears to confirm that inflation is not a long-term influence on stock prices.

Inflation’s Impact on Bonds is More Durable

Bonds tell a somewhat different story. Historically, the long-term average return on bonds has been higher than the rate of inflation. But the gap has been narrow.4

During the great inflation, average bond returns were actually lower than the average rate of inflation.5 But inflation presents a longer-term problem for bonds.

Inflation erodes the purchasing power of the income they generate – even when inflation is mild. As bonds mature, their proceeds may also have less purchasing power than the funds originally invested in them.

This was the case in the 1970s.

So, while history has demonstrated that mild inflation has not negatively impacted the long-term performance of stocks, it can be problematic for bonds.

Working with experienced financial professionals can help you stay the course. They can provide guidance and encouragement to help focus your attention on your long-term goals.

[1] Source: U.S. Federal Reserve.

[2] Between January 1, 1960 and December 31, 2022, common stocks delivered an average annual return of 11.51 percent. Inflation averaged 3.76 percent in that time. Sources: U.S. Federal Reserve, S&P Global Market Intelligence/Leveraged Commentary and Data, other publicly available data.

[3] Michael Bryan, Federal Reserve Bank of Atlanta, The Great Inflation: 1965–1982, November 22, 2013.

[4] Between January 1, 1960 and December 31, 2022, 30-year U.S. Treasury bonds delivered an average annual return of 4.87 percent. Inflation averaged 3.76 percent in that time. Sources: U.S. Federal Reserve, S&P Global Market Intelligence/Leveraged Commentary and Data, other publicly available data.

[5] Between January 1, 1965 and December 31, 1982, 30-year U.S. Treasury bonds delivered an average annual return of 5.23 percent, inflation averaged 6.56 percent. Sources: U.S. Federal Reserve, S&P Global Market Intelligence/Leveraged Commentary and Data, other publicly available data.