You’ve inherited a loved one’s assets – now what?

Inheriting money can change your life. Even a modest inheritance can produce tangible future benefits. An inheritance may help you achieve financial objectives that might not be attainable otherwise. So, it’s important to carefully consider what to do with inherited assets. It’s also important to think about the ramifications of your decisions.

Investment and tax Opportunities

Investments held in taxable accounts at a brokerage firm or mutual fund company can pass to heirs directly. In other words, they don’t have to be sold before they get transferred into your name. And this is a situation that may create some opportunities.

The first is that the inherited assets may compliment your (hopefully) already diversified portfolio. If they are appropriate for what you’re trying to accomplish financially, then great. You don’t have to do anything with them.

But if they don’t fit your mix or they sway your asset allocation too much in one direction, then you may decide to reallocate them (i.e., sell some or all of the position and reinvest the proceeds in something more suitable). And there’s a tax consequence for selling inherited assets.

Fortunately, any potential tax burden may likely be a lot smaller than you might think. This is because inherited assets enjoy what’s referred to as a step up in basis.

When you inherit investments, you don’t inherit them at their cost basis (what the original investor paid for them). Their value on the day they transfer to you is (for income tax purposes) your cost. In most cases, that “cost” is higher than the original purchase price. It’s stepped up.

So, the good news is that your taxable gain or loss on any sale is based on this new stepped up acquisition value. Here’s how this works.

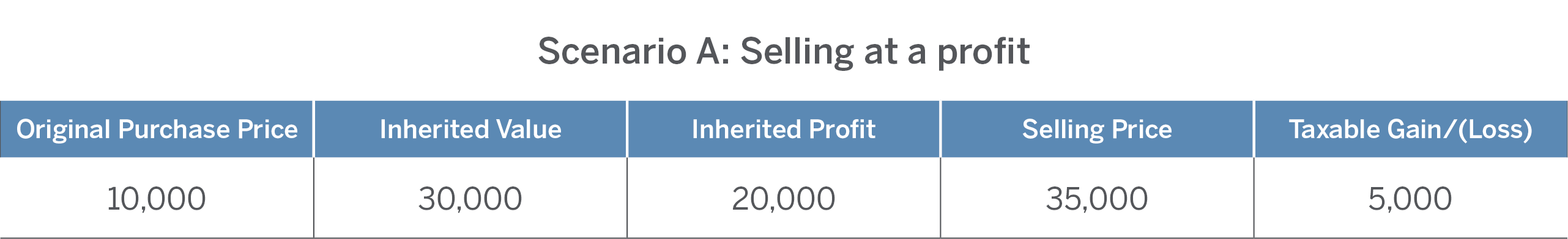

Let’s say you inherited a mutual fund from a relative who paid $10,000 for it. The day that the fund transfers into your name, it’s worth $30,000. You inherit the imbedded profit. Your “cost” is stepped up to $30,000. Now, let’s assume you decide to sell the fund.

If you sell the fund for $35,000. Your profit is $5,000. That’s a taxable gain that you’ll report on your annual income tax return. And you may owe money on it.

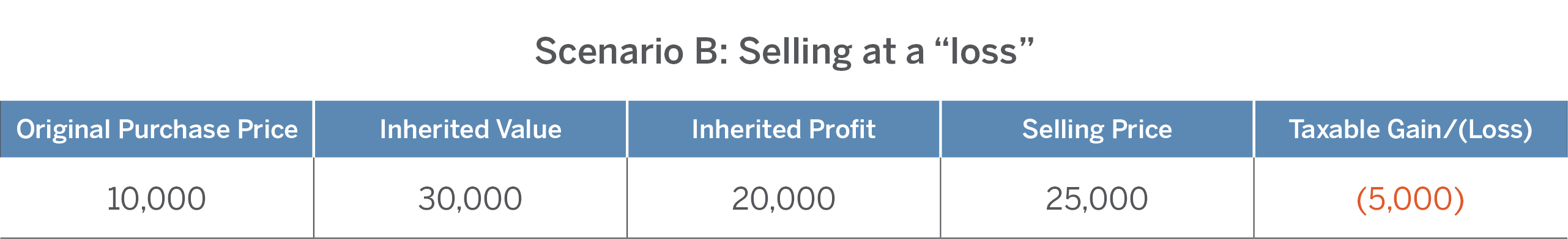

But what if you sell the fund at a loss? Remember, you inherited the fund when it was worth $30,000. If you end up selling it for $25,000, then you’ll have a loss of $5,000.

So, even if you inherit assets with a built-in gain, you may have an opportunity to create a taxable loss on their sale. But you should have a conversation with your tax advisor before making any move based on its tax consequences.

Investment Objective and Risk Tolerance

More important than the income tax implications that come with inherited investments is their appropriateness relative to your unique investment goals and financial objectives. Key among these is your risk tolerance.

Just because you inherited something from someone you loved doesn’t mean you should remain invested in it. If it is counterproductive to what you’re trying to achieve or exposes you to uncomfortable risk, you should reevaluate its place in your portfolio.

Separating the emotion from the inherited investment may be a difficult challenge. But the person who left you the money likely did it because they loved you, not the investment. So, being sentimental is probably not your best investment choice.

An Investment Professional can Help

That’s why it makes sense to work with an investment professional who can help you navigate sensitive times, like when you inherit investments from a loved one. And you can find that person by calling us at (800) 235-8396.